After years of helping families grow, protect, and eventually pass down their wealth, here’s a secret that won’t show up on any balance sheet or net worth summary: the families who do it best? They talk. Not just about dollars and portfolios, but about values, goals, and what it all means.

Wealth transfer isn’t a one-and-done event—it’s a decades-long conversation. And like anything that lasts that long (marriage, sourdough starters, houseplants), it needs attention. That’s why we’re big fans of the family meeting—the single most underrated tool for creating a lasting legacy.

Now, before you imagine a tense PowerPoint session in the dining room—relax. These meetings aren’t about revealing net worth or hashing out who gets the beach house. They’re about starting open conversations. Why did Grandpa or Mom invest the way they did? What causes matter most to the family? What do we actually want this wealth to support?

When families skip these talks, it leaves space for confusion, resentment, or those awkward Thanksgiving moments. But when they lean in—sharing hopes, fears, even funny stories—something special happens. Money becomes more than numbers. It becomes meaning.

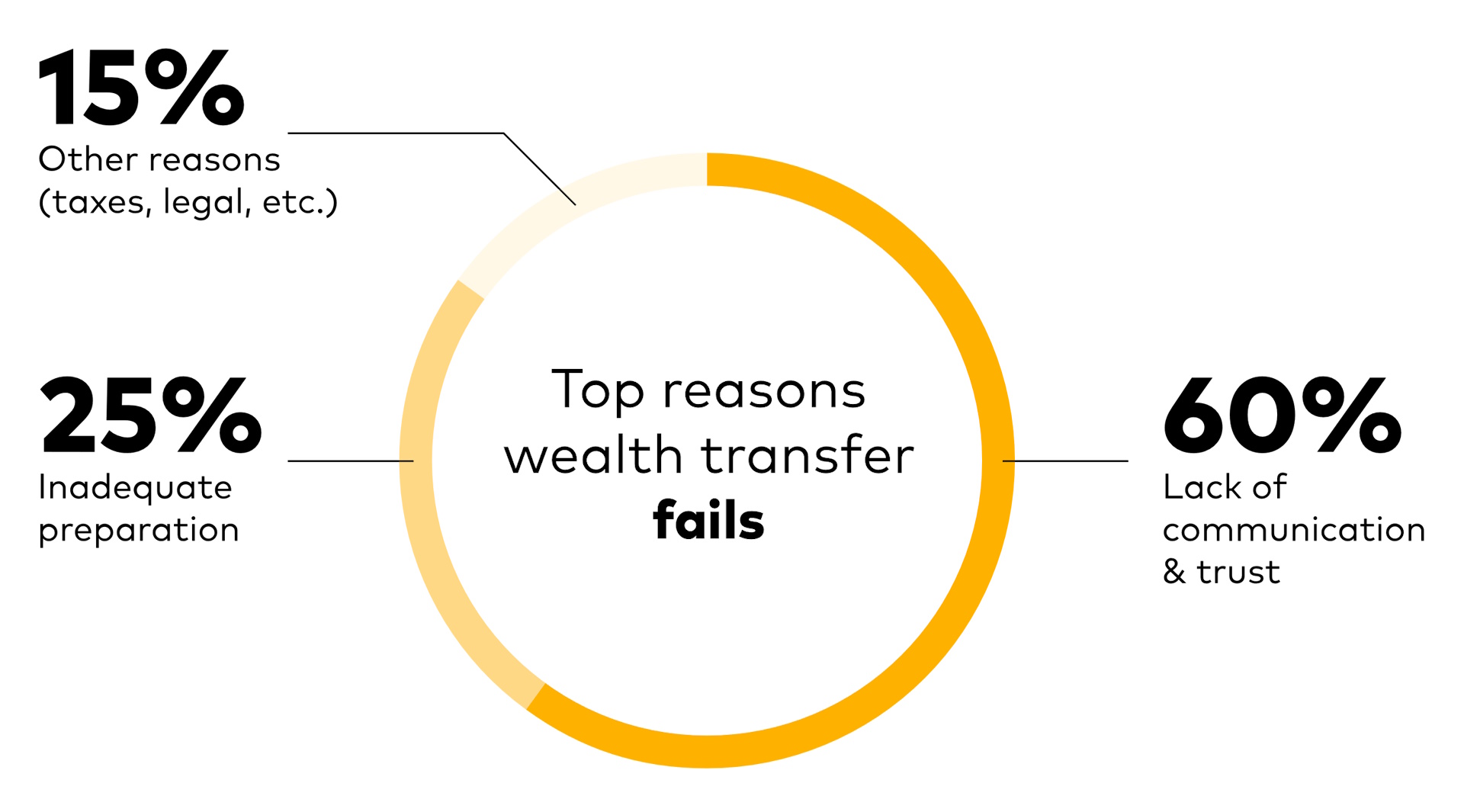

Top reasons wealth transfer fails

Source: Vanguard This graphic shows the reasons families in the study failed to transfer their wealth successfully. 60% failed because of a lack of communication and trust in the family, 25% because of inadequate preparation, and 15% for other reasons, such as tax and legal issues.

In Louisiana, where family and tradition are practically part of the water, this kind of connection is powerful. Family meetings add structure to the stories and give purpose to the planning.

And look, these don’t have to be formal. Some of the best conversations happen at the kitchen table, over gumbo or during a holiday. Talk about values, giving, or even introduce younger generations to how wealth works—with or without spreadsheets. Most times, having a financial advisor in the room helps too (especially one who’s not related to you—we can do that!!).

Bottom line? You don’t need a big life event to get started. Start small. Share why you give. Talk about what you’ve learned. Small moments build trust. And trust is the cornerstone of every lasting legacy.

At the end of the day, wealth isn’t just about what you leave behind. It’s about who you leave it to—and whether they’re ready for it. It’s about decisions. It’s about direction. And it’s about family. If you want your financial legacy to endure, start by inviting the next generation to the table.

Ready to start the conversation? We’re here when you are—ask us how to help and get started.

https://investor.vanguard.com/wealth-management/family-legacy-services/knowledge-center/preparing-wealth-transfer#modal-chart-desc