Has there ever been an investable asset that has gotten a worse rap?

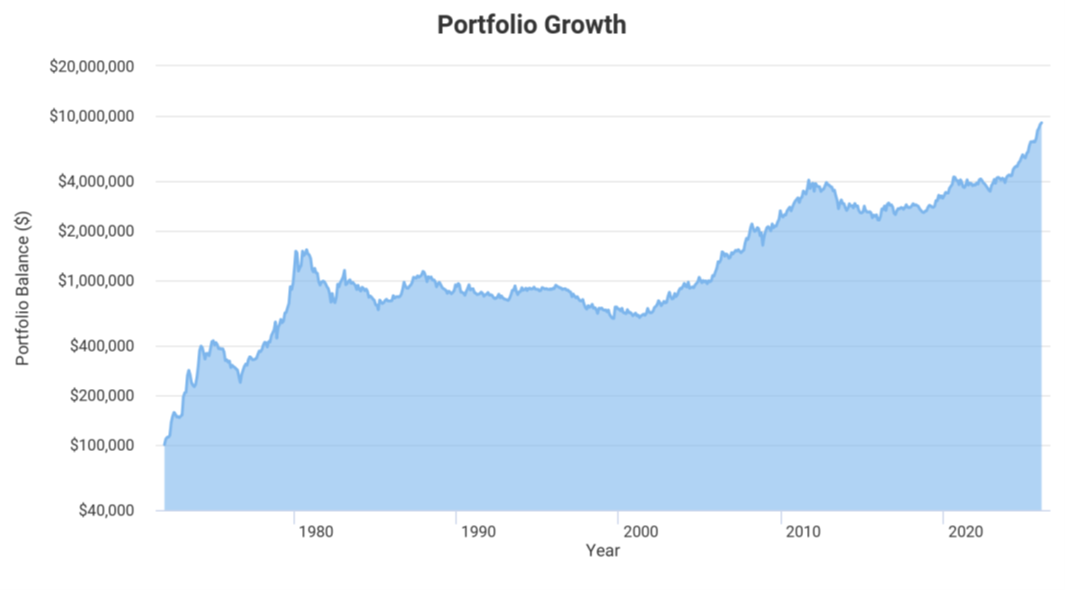

The chart below shows the performance of gold, dating from 1972 through 2025. Point to point, not too bad at all. And yet, despite this performance record, for the entire 40-year period that I have been involved with the financial markets, most of the press and opinions regarding gold have been disparaging (the “barbaric metal”) – not something a serious investor would include in their investment portfolio.

Growth of $100,000 invested in physical gold, 1972-2025. Past performance may not reflect future results. Results generated by Portfolio Visualizer (Source: www.portfoliovisualizer.com)

Why is that?

I personally think that outlook probably started with Warren Buffett’s comments on gold, first made in the late 1970’s. Gold was simply not something he was interested in.

He said (paraphrasing), “For an asset to hold value, it must produce cash flow. Since gold does not create earnings, dividends, innovation and has no self-generating pricing power, it does not meet my test for an investable asset.”

I believe that Buffett’s view on gold is correct when gold is viewed as a standalone asset. It seems that everybody else also agreed, as they took Buffett’s pronouncements as gospel.

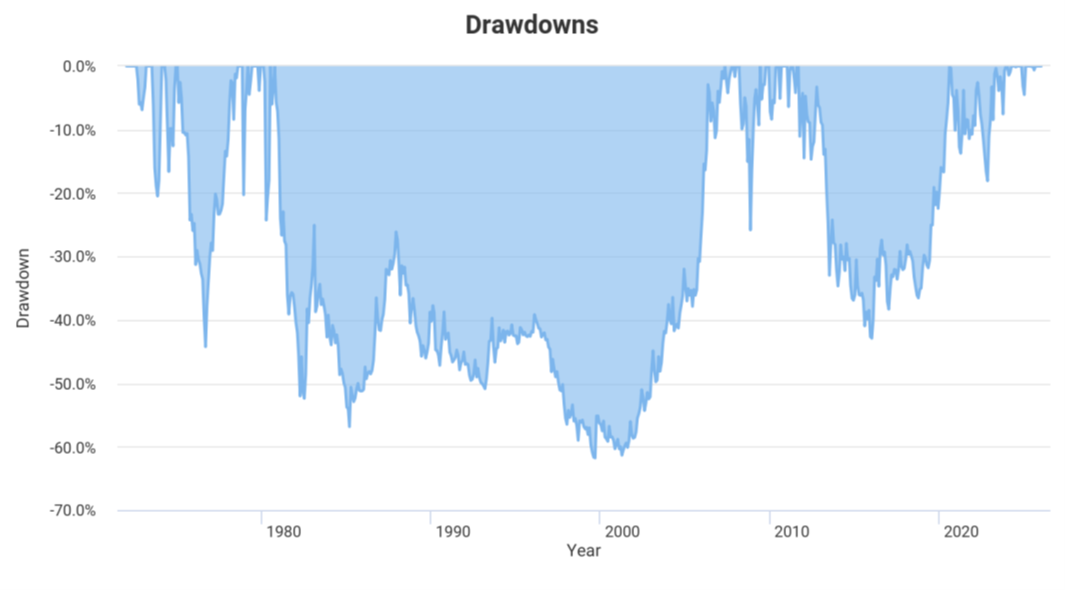

Holding gold as a single asset can be tough. As a standalone asset, gold can be quite volatile. Just look at a plot of gold drawdowns (selloffs) from 1972 through 2025, and this can be seen quite clearly:

Again, past performance may not reflect future results. Above results generated by Portfolio Visualizer (Source: www.portfoliovisualizer.com)

While gold may be a terrible singular asset, within the structure of a diversified portfolio it can work wonders as shown in the following hypothetical table (for illustrative purposes):

Comparison of 100% US Stocks (Total Market), to a 75% Stock/ 25% Gold allocation, rebalanced annually from 1972 through 2025. This is not a portfolio; it is the outcome of the underlying indexes, used in the percentages shown. You cannot invest directly in an index. Past performance of indexes represented may not reflect future results. Results generated by Portfolio Visualizer (Source: www.portfoliovisualizer.com)

Think about what the above data tells us. As a standalone asset, owning gold can be really tough, but add it to a portfolio that holds other assets such as stocks, and it can create a more optimal portfolio strategy. It has allowed a diversified portfolio to realize a higher overall return (i.e. more money earned) over certain historical periods with a smoother ride along the way.

That has always sounded pretty good to me, and that is exactly why BCM has included gold in some of its investment strategies for many years.