“I Will Track You Down and Pull Out Your Beard Hairs One by One”

I received the following email from a long-standing client regarding President Trump’s executive order allowing alternative investments such as private equity and crypto assets in 401k plans.

Montgomery:

I understand that we can now put some 401K’s into such things as cryptocurrencies and private equity offerings.

If this should happen in our accounts, we will cease being clients of BCM and I will track you down and pull out your beard hairs one by one.

Well, not really that last part. Just keep our investments safe.

While I almost spit out my coffee, it does illuminate some important thoughts on the risks of private equity investments that should be considered by those with retirement accounts.

Let’s start with the following quote:

“What the wise do in the beginning, fools do in the end.”

– Warren Buffett

Private equity has historically delivered stronger risk-adjusted returns1 than the public markets, attracting big dogs like Ivy League endowments. But these gains come at the cost of liquidity, where funds can be locked up for years as managers allocate capital into private investments that can take time to generate profits.

With the Trump Administration threatening to cut federal funding, some endowments are facing a cash crunch. As endowments hold back on contributions to conserve cash, private equity funds are looking elsewhere for fundraising – How about the $12.4 trillion sitting in U.S. workplace retirement plans?2

Private Equity Fund Costs

Now that these funds will be available in 401k plans, Wall Street says that this makes alternative investments available to all, bringing previously exclusive investments within reach of almost any investor. *

How charitable. What they don’t mention are the fees needed to run these private equity funds, ultimately digging into performance. On average, private equity funds charge 2.5% annually. By comparison, target-date retirement funds (which are offered in many 401k plans) have average expense ratios of 0.30%, costing 10 times less comparatively.3

Illiquidity Risks

As mentioned previously, higher returns in private equity funds come at the cost of liquidity. You can put in as much money as your heart desires, but typically there are restrictions on when and how much you can pull out.

Many funds set predetermined distribution intervals limited to a certain percentage of shares per quarter. Others can be more restrictive (e.g., tender-offer funds), which allow redemptions up to a certain amount but ultimately don’t have to be honored if management needs the capital.

While this may not be a major consideration for younger investors who are accumulating long-term funds in a retirement plan, it may be challenging, or downright inappropriate, for those in retirement needing 401(k) monies to support their living expenses.

Price Transparency

Since private equity funds are private, they are also not priced in real time such as publicly traded securities. Instead, their investments are valued periodically and rely on different methodologies to determine their fair value, making pricing standards somewhat subjective.

Further, since private equity funds do not price daily, volatility can be minimized. From a behavioral standpoint, this could be viewed as beneficial to helping investors stay the course, but it can understate the actual volatility these funds experience which might misalign with an investor’s overall risk tolerance.

Find the Winner

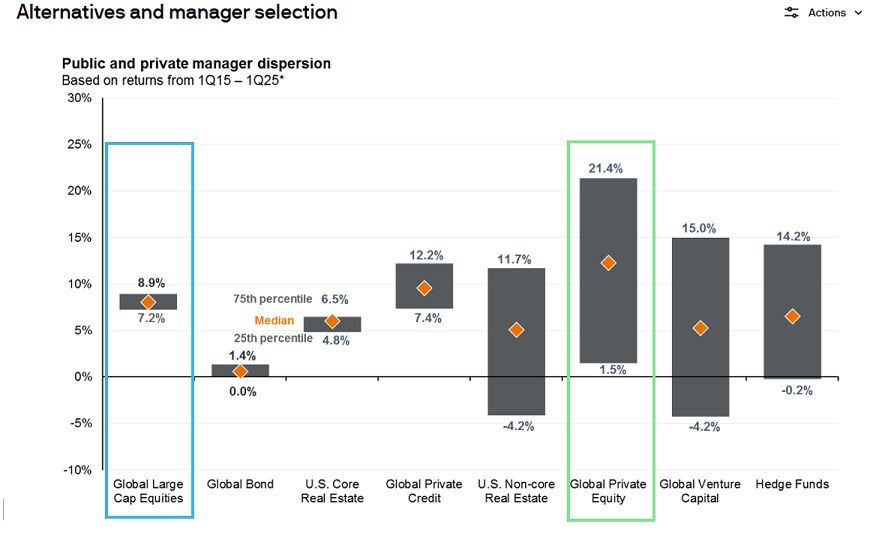

The average returns of private equity funds can look attractive, but how does one find the right one consistently? Among the different private equity funds, average fund returns have ranged from 21.4% to 1.5% since 2015.4 To illustrate, the graph below highlights the dispersion of returns among global large cap equities (blue box) compared to global private equity (green box).

With a wider range of return outcomes, choosing the right private equity fund manager becomes critical. While strong risk-adjusted returns are possible, finding consistent winners is challenging. Choose wisely.

While the temptation of higher returns might enchant 401(k) investors, it is important to understand the impact it might have on funding one’s retirement needs. Look no further than the issues facing university endowments as a cautionary tale for evaluating both the opportunities and risks in meeting your financial goals.

If you have any questions, give us a call. Additionally, if you believe this information could help others, please pass it along.

Bibliography

J.P. Morgan Asset Management. (2025, May 31). Guide to Alternatives. Retrieved from JP Morgan: https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-alternatives/

Private Equity Wants a Piece of Your 401(k). (2025, March 7). Retrieved from Barron’s: https://www.barrons.com/articles/retirement-401k-private-equity-62be9228?mod=article_inline

Ptak, J. (2025, August 11). 75% of Alternative Mutual Funds Have Died. There Are Lessons in That for Would-Be Private Market Investors. Retrieved from Morningstar: https://www.morningstar.com/alternative-investments/75-alternative-mutual-funds-have-died-there-are-lessons-that-would-be-private-market-investors?utm_source=eloqua&utm_medium=email&utm_campaign=AdvisorDigest&utm_content=None_66298&utm_id=34436

Shannon, J. (2025, June 11). How Attractive Is Private Equity? Retrieved from Morningstar: https://www.morningstar.com/funds/how-attractive-is-private-equity

Zweig, J. (2025, July 25). The Wall Street Journal. Retrieved from Wall Street’s Big, Bad Idea for Your 401(k): https://www.wsj.com/finance/investing/wall-streets-big-bad-idea-for-your-401-k-f1003137?mod=Searchresults_pos1&page=1

Zweig, J. (2025, May 16). This New Investing Idea Isn’t Right for Your Retirement Plan. Retrieved from The Wall Street Journal: https://www.wsj.com/finance/investing/this-new-investing-idea-isnt-right-for-your-retirement-plan-480582de?mod=Searchresults_pos9&page=1

1(Ptak, 2025)

2(Zweig, This New Investing Idea Isn’t Right for Your Retirement Plan, 2025)

3(Private Equity Wants a Piece of Your 401(k), 2025)

4(J.P. Morgan Asset Management, 2025)

* “What the wise do in the beginning, fools do in the end.” – Warren Buffett