You all remember William of Occam, don’t you? Sure you do! William of Occam was one of the major figures of 14th century medieval thought and is mostly remembered for his principle known as Occam’s Razor. This principle states that (and I’m paraphrasing here…), “When confronted with multiple solutions, go with the simplest”. In other words, avoid complexity when you can.

****************************

It is surprising how often Occam’s Razor is ignored – even by supposedly smart people.

Author Trent Griffith relates the following story that beautifully illustrates the point.

“Too many people take a situation and create complexity where none is needed, Take for example the old joke about unneeded complexity at the National Aeronautic Space Agency. Early in the space program NASA discovered that ballpoint pens would not work in zero gravity. NASA scientists spent a decade and huge amounts of money developing a pen that not only wrote in zero gravity, but on almost any surface, at extremely low temperatures and in any position of the astronaut. The punch line is, the Russians instead used a pencil.”

So, how does simplicity relate to investing in equities?

Well, let’s look at the recent data provided by the latest SPIVA (Standard & Poor’s Index vs Active Management) report.

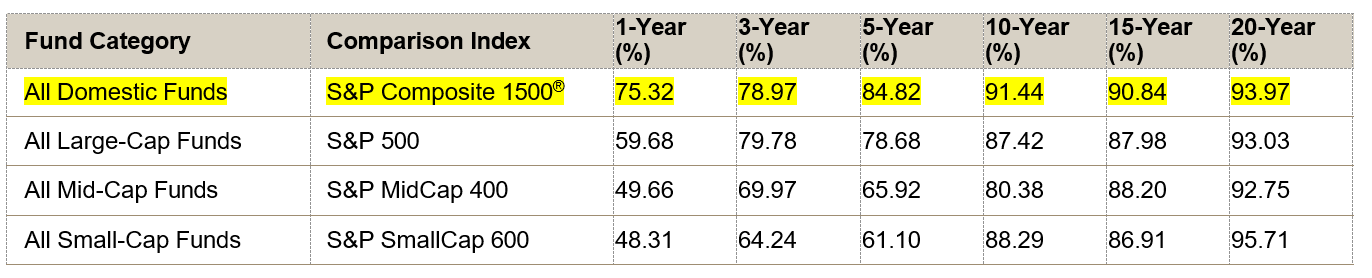

Percentage of U.S. Equity Funds Underperforming Their Benchmarks (Based on Absolute Return)

Source: S&P Dow Jones Indices LLC, CRSP. Data as of Dec. 31, 2023. Past performance is no guarantee of future results. Table is provided for illustrative purposes.

Once again, professional active managers, with all of their attendant resources just can’t seem to cut the mustard here. Yet, despite the above evidence, investors are still drawn towards chasing the holy grail of trying to beat the market.

****************************

We recommend avoiding needless complexity. For equities this can be accomplished by owning all of the nation’s publicly held businesses and at the lowest cost. By doing you will be able to capture the return that these businesses generate in the form of dividends and earnings growth. And as the data above illustrates, at the end of the road we are highly likely to outperform the vast majority of “smart money investors”.